are nursing home expenses tax deductible in canada

You may claim 100 of the cost of your nursing home stay or long-term care facility if your DTC is approved by the CRA and either a letter from a qualified clinician or a formal form from a corporation. Child Care expenses come up in Canada Revenue Agencys personal tax audits because they are considered part of income whereas tax credits which typically amount to 15 fall solely on income.

Can You Claim Nursing Home Expenses On Taxes In Canada Ictsd Org

If it is not for medical.

. Table of contents are nursing home costs tax deductible in canada. Robert qualifies as a chronically ill individual because he is unable to perform at least two ADLs. Generally you cannot claim the entire amount you paid for a retirement home or a home for seniors.

June 5 2019 249 PM. Are assisted living expenses tax deductible in Canada. Salaries and wages for attendant care given in Canada.

If you your spouse or your dependent is in a nursing home and the primary reason for being there is for medical care the entire cost including meals and lodging is a deductible medical expense. Most rent expenses cant be claimed either with the exception being any portion of the rent that goes to services that help a person with daily tasks such as laundry and housekeeping. Medical expense deductible expense deductions credits expenses child care child care expenses education education tax credits disability disability tax.

Nursing home expenses are allowable as medical expenses in certain instances. If you your spouse or your dependent is in a nursing home primarily for medical care then the entire nursing home cost including meals and lodging is deductible as a medical expense. To qualify for all costs included in the cost of a nursing home or a long-term care facility you must have a CRA-approved DTC Certificate or write a letter of referral from an authorized medical provider.

Age 51 to 60. If you your spouse or your dependent is in a nursing home primarily for medical care then the entire nursing home cost including meals and lodging is deductible as a medical expense. Costs for memory care assisted living and other arrangements are only partly deductible to the.

Expenses for an actual nursing home where someone goes mainly for nursing and other medical care are deductible medical expenses. Most individuals are unaware how expansive the term Qualified Medical Expenses are in the tax code. Administrative costs and operating costs cant be deducted.

Yes in certain instances nursing home expenses are deductible medical expenses. Eligibility for the disability tax credit may be a requirement to claim fees for salaries and wages as medical expenses. Nursing homes and long-term care facilities do not have these as part of their benefits.

Age 71 and over. This can include the part of the nursing home fees paid for full-time care that relate only to salaries and wages. What Qualifies As Medical Expenses When Filing Taxes.

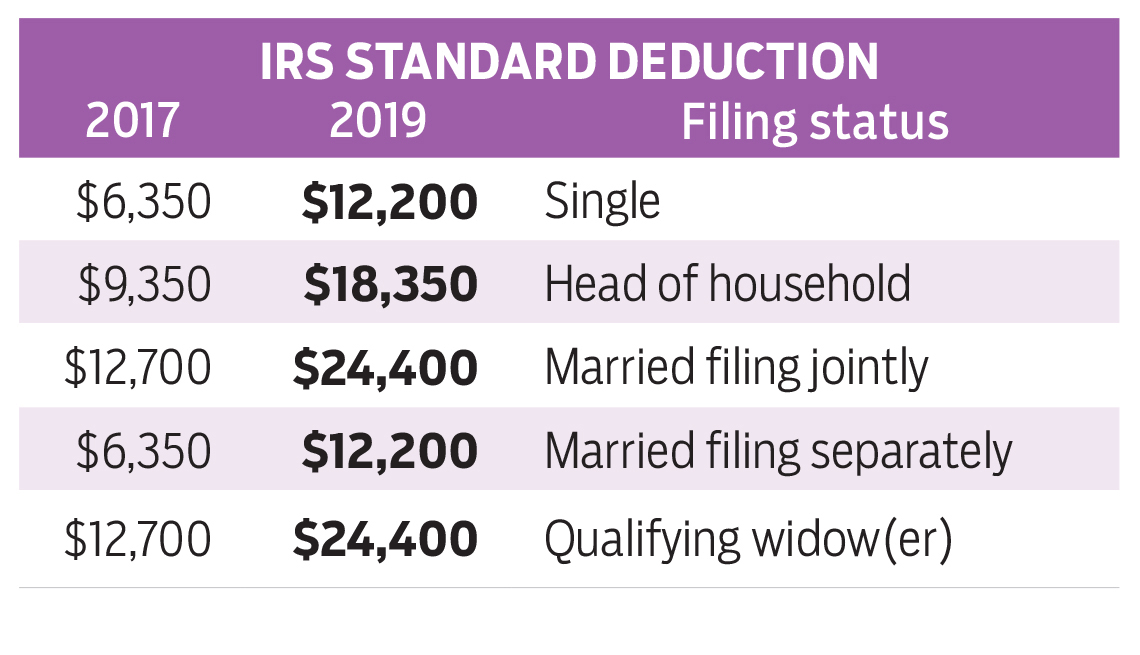

The federal and Ontario governments have tax credits available to taxpayers including those paid for medical expenses. Generally CRA inquiries for discrepancies in. Your qualified long-term care insurance premium payments are deductible if theyre itemized on your 2021 federal taxes but are subject to limitations based on the policy holders age.

This depends on why your mother is in a nursing home. Depending on the situation nursing home expenses may qualify as deductible medical costs. An eligible medical expense must be medically necessary for the health and well-being of you or a member of your taxable household.

If it is for medical reasons then yes the costs are deductible. Age 40 or under. This is an announcement regarding tax-deductible limits for long-term care insurance in 2020.

If you your spouse or your dependent is in a nursing home primarily for medical care then the entire nursing home cost including meals and lodging is deductible as a medical expense. To qualify your long-term care insurance. Nursing homes special rules apply to this type of facility see the chart.

How to Deduct Nursing Home Costs and Expenses from Your Taxes. The list of tax-deductible medical expenses is long and additional expenses may be eligible beyond what is listed by the Canadian Revenue Agency CRA. Are Home Care Expenses Tax Deductible In Canada.

He paid the nursing home 75000 in 2019. Not all nursing home expenses can be claimed. Can I deduct these expenses on my tax return.

You must also meet the criteria related to income. You were resident in Canada throughout 2020. As long as it is primarily for medical purposes the cost of nursing care that you receive whether youre visiting your spouse or your dependent is deductible as a medical expense.

The Medical Expense Tax Credit METC can be claimed for costs associated with nursing and retirement homes that are paid by you or your spouse. Certain medical expenses are generally deductible as an itemized deduction on an individuals income tax return. The entire 75000 paid to the nursing home is deductible on Roberts 2019 individual tax return as a medical expense subject to the AGI limitation because it is for qualified long-term care services.

Are retirement home fees tax deductible in Canada. However you can claim salaries and wages for care in such facilities if the care recipient qualifies for the disability tax credit see Salaries and wages. METC claims depend on several factors including the kind of facility you reside in.

If that individual is in a home primarily for non-medical reasons then only the cost of the actual. Are Long-Term Care Expenses Tax Deductible In Canada. Watch Are Nursing Home Costs Tax Deductible In Canada Video.

You can claim the disability amount and up to 10000 for these expenses 20000 if. Age 41 to 50. You were 18 years of age or older at the end of 2020.

You made a claim for medical expenses on line 33200 of your tax return Step 5 Federal tax or for the disability supports deduction on line 21500 of your tax return. Yes in certain instances nursing home expenses are deductible medical expenses. There is a 10540 limit for 2019.

Retirement homes homes for seniors or other institutions that typically provide part-time attendant care. A person who is 70 or older has the right kind of long-term care insurance policy both in person and at wwwirsgov can deduct 10860 for 2020 as part of IRS Revenue Procedure 2019-44. Are my mothers nursing home expenses which she pays deductible.

There can be a claim for nursing home expenses that is deductible. Age 61 to 70. Yes in certain instances nursing home expenses are deductible medical expenses.

Expenses from nursing homes or long-term care facilities that cannot be claimed without. Group homes in Canada. You your spouse or your dependent are covered for the cost of living excluding meals and lodging in a nursing home if the primary purpose of staying there is medical.

Are Retirement Home Expenses Tax Deductible In Canada Ictsd Org

What To Know About Deductible Medical Expenses E File Com

Tax Tip Can I Claim Nursing Home Expenses As A Medical Expense 2022 Turbotax Canada Tips

What Are Tax Deductible Medical Expenses The Turbotax Blog

Imgur The Most Awesome Images On The Internet Flow Chart Finance Advice Personal Finance Advice

Tax Deductible Medical Expenses In Canada Groupenroll Ca

What To Know About Deductible Medical Expenses E File Com

What Tax Deductions Are Available For Assisted Living Expenses

Are Assisted Living Expenses Tax Deductible In Canada Ictsd Org

What Medical Expenses Can I Claim On My Taxes In Canada

Irs Publication 502 Medical Expense What Can Be Deducted Tax Free Core Documents

What Are Tax Deductible Medical Expenses The Turbotax Blog

Rental Property Management Template Long Term Rentals Rental Etsy Rental Property Management Property Management Rental Property

Give To Charity But Don T Count On A Tax Deduction

Private Home Care Services May Be Tax Deductible

Medical Expenses What It Takes To Qualify For A Tax Deduction Insight Accounting

Sample Of Excel Spreadsheet Excel Spreadsheets Excel Templates Excel For Beginners

Are Medical Expenses Tax Deductible

6 Overlooked Tax Deductions And Credits That Could Score You A Big Return National Globalnews Ca